Why Use Reptax?

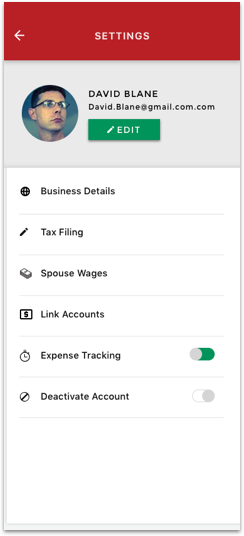

Running your real estate business is a FULL TIME JOB. Reptax allows you to spend LESS TIME on accounting and bookkeeping and more time meeting new clients, getting listings and selling properties. You focus on making more money, we will focus on helping you KEEP MORE OF IT! Reptax is operated by professional tax advisers, IRS Enrolled Agents and CPA’s who focus on Real estate professionals! This program is ONLY FOR YOU.

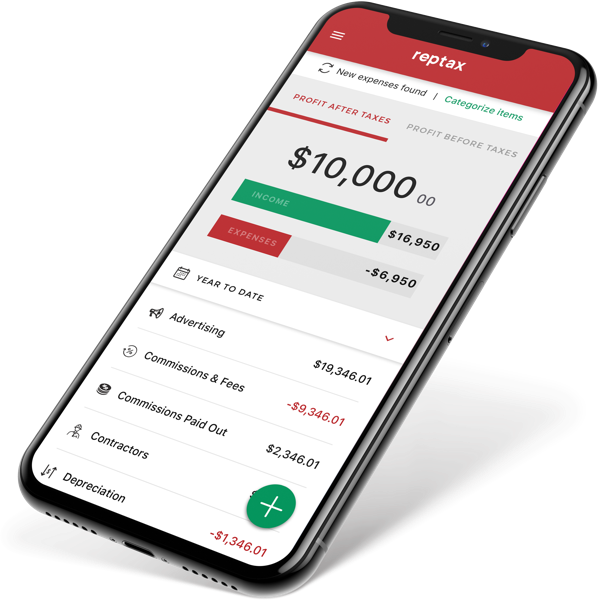

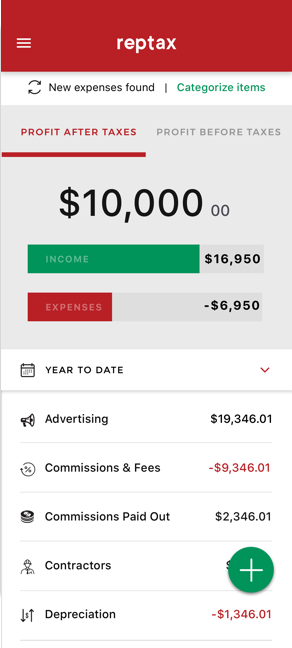

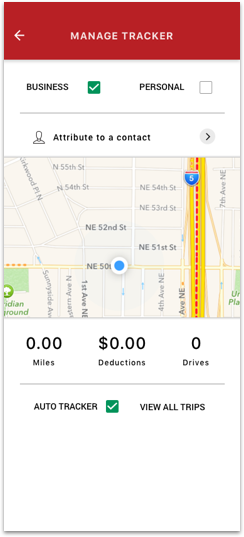

With Reptax, you choose your level of involvement in your Income and Expense Tracking.

- Manually enter your income and expenses. (most time consuming)

- Securely connect your bank and credit card accounts and simply code transactions as they appear in your program (our program offers smart learning so transactions can be automatically categorized over time. (much less time consuming)

- Have a Reptax Professional, code your expenses for you, so you never have to remember to code any transactions at all, like having your own bookkeeper. (the most hands off approach)

YOU CHOOSE!!

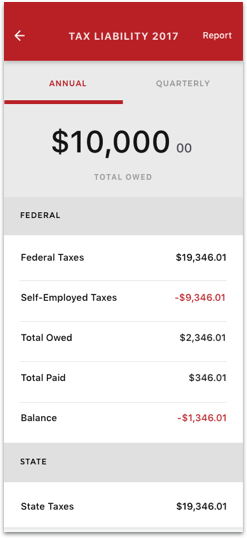

With Reptax you will have a snapshot of how much taxes you owe at ANY TIME!

This will allow you to allocate your finances. Reptax also takes into account income you or your spouse (if married filing jointly) have earned outside of your real estate business. Now you have a MORE ACCURATE picture of your tax situation.

KNOWLEDGE is Power! Having a snapshot of your tax due WILL HELP US, HELP YOU, SAVE A LOT OF MONEY!

Reptax Will send you alerts if you are OVERPAYING your taxes.

The MAJORITY of real estate professionals are overpayingTAXES by THOUSANDS OF DOLLARS EVERY YEAR.

By simply tracking your transactions we can customize a plan for you that will save you thousands of dollars. Why pay more in taxes if you can keep more of your money?

Previous

Next